I have been pondering what to write about ‘Liberation day’ since April 2- the day itself. Trump unleashed the stupidest tariff war, writing off over six trillion dollars of stock market value in the two days that followed. The stock market isn’t the economy but any time the stock market drops 10% in two days it is time to be concerned.

I’m going to try to break this down a bit for myself and hopefully doing so will help others who are attempting to parse the events. What follows is an expression of my opinion based on actual analysis: you may disagree with me freely, but I am reasonably secure in my understanding of the facts. This is a long one- Buckle up, and feel free to use the table of contents to jump around to what interests you!

What the Orange Emperor did

April 2nd was Trump’s “Liberation Day”: he announced universal 10% tariffs (import taxes) with massively higher charges for 70+ countries he accused of having high reciprocal import fees or of otherwise having unbalanced trade. All of these tariffs were planned to become active within a week of announcement.

This whole phalanx of tariff mayhem came after Trump invoked 25% tariffs on his two largest trading partners, Canada and Mexico. Then reversed the tariffs. Then invoked them again.

No one could logically explain Trump’s “Liberation Day” calculation of purported tariffs charged by other nations that his plan was supposed to be responding to. The numbers didn’t match any known tariff plans, and in some cases were applied to nations or land masses without any people and thus no imports or exports to tax. China announced punitive tariffs in response to the plan’s 34% tariff on them, and Trump doubled down eventually landing on a tariff of 145% on all imports from China.

The U.S. stock markets lost over 10% amounting to approximately six trillion dollars in value in the two trading days that followed “Liberation Day”. Trump and his closest loyalists continued to tout the expected benefits of his tariffs for several days. The stock markets continued to variously crash then rally any time rumours spread of a possible rollback of the tariff plan.

Troubling changes started to occur in the U.S. treasury bond market as the stock markets continued to gyrate in a downward fashion. An apparent sell-off of these bonds was triggering increases in future rates, illustrating a marked decline in faith regarding U.S. financials. Increasing treasury bond rates would result in increases to corporate and consumer interest rates if they persisted for any length of time..

Trump suddenly reversed course on April 9th pausing his tariff plan for 90 days. The stock markets rebounded after this announcement, then started to trend downwards again. The ‘pause’ leaves the global 10% tariff in place as well as the 145% tariff against Chinese imports.

What are tariffs?

A tariff is a tax payed by importers of foreign goods. China does not pay the tariff if the U.S. implements a tariff against them: the American company or person that imports the Chinese product pays it. It is only a ‘punishment’ against the foreign supplier in the sense that sales of their product may decrease in the importing country due to the increased cost in that country of their goods.

Generally tariffs are passed on directly to the consumer by the importer. This makes tariffs functionally a hidden sales tax paid by the consumer on goods from given countries. Importers may choose to ‘absorb’ some or all of the tariffs by reducing their profit margin, but this reduction in profit directly impacts a company in the taxing country.

Tariffs are generally used on targeted products to ‘protect’ strategic industries in the taxing country. For example, a country might want to be sure they have a strong native steel industry, so a tariff will be applied to make sure foreign steel costs more/is more expensive, allowing the local industry to stay viable. Tariffs also generate consumer tax income for the host country.

The downside to tariffs is that they raise prices for consumers and they effectively weaken competitiveness of the native industry. Increased consumer costs can result in higher inflation rates. Native industries lose incentives to increase quality and efficiency in their product as they no longer have to compete with foreign suppliers.

Trump’s lies and weird numbers

There is a truism I ascribe to: if Trump is speaking, he is lying. The man lies about big things and little things, important things and irrelevant things: he even lies to contradict lies he told you five minutes ago. I feel that many of his lies are ones he tells himself as much as he tells others in order to fill the gaps his ignorance leaves. This is not new.

What is new is the global financial impact his lies and ignorance are having. Here are a few of the worst lies and stupid concepts that fuelled Trump’s tariff war.

“Magical tariffs”

The Big Lie that Trump tells repeatedly is that tariffs are paid by the foreign country: please see ‘What are tariffs?‘ above to understand how wrong this is. As any economist will tell you, tariffs are taxes paid by the importer of goods i.e.: American citizens in the case of Trump’s tariffs. Ultimately that tax is paid by the consumer through increased costs of goods.

Trump also says that tariffs will ‘quickly’ bring manufacturing back to the U.S. thereby adding lots of new jobs. There are a lot of reasons why manufacturing and service business has been offshored over the last 50 years. None of those reasons can be ‘reversed’ quickly: it takes many years and huge investments for corporations to relocate their industries. And even if all that work came back tomorrow, the products produced would be more expensive than they are today.

He then says that tariffs are a new revenue stream and he can use the money they generate to reduce income taxes. But if tariffs work to bring manufacturing back to the U.S. then fewer goods will be purchased from foreign countries, reducing the revenue from tariffs. This means that income taxes will eventually have to go back up. And you can guess who will get these tax breaks while they last. Hint: it won’t be the lower or middle classes.

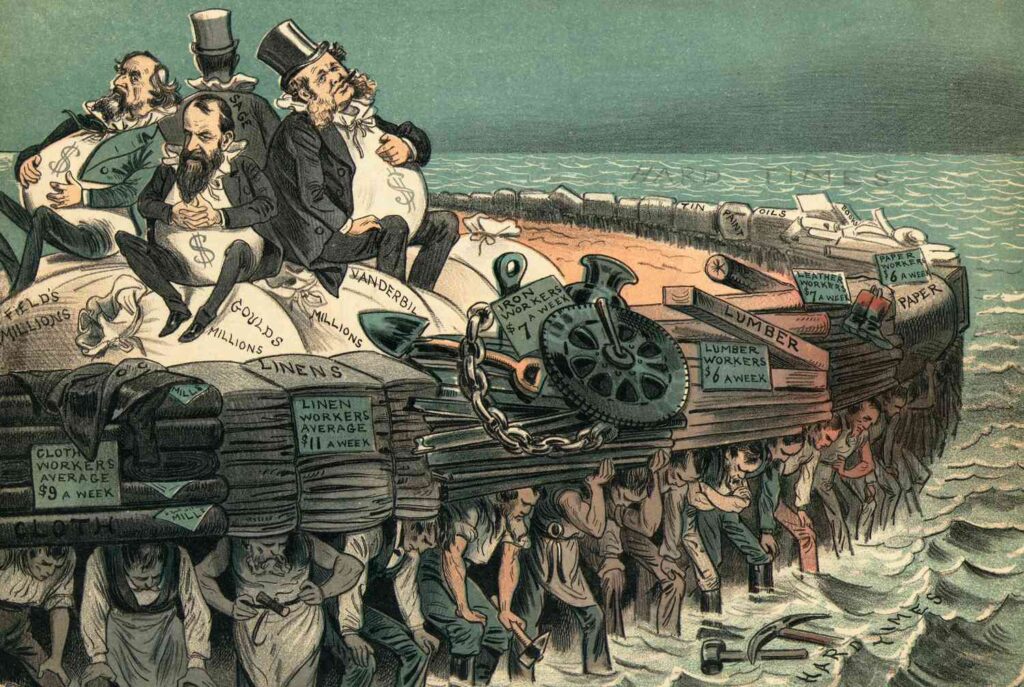

“Gilded age greatness”

The other Big Lie that Trump has put forward is that America experienced a ‘golden age’ in the past when tariffs were broadly used. The time he is referring to is roughly the time of the ‘Gilded Age’ between about 1860 and 1930.

This was a time when workers had basically no rights, unions were broken violently by corporate thugs, and the vast majority of wealth was in the hands of a very small minority. It is widely believed that tariffs applied by America were an indirect cause of the Great Depression. I’ll get into this a bit more in the ‘enshittification’ section later in this post.

“Trade imbalances are tariffs”

Trump presented a cardboard sign with his new tariffs for individual countries emblazoned on it on “Liberation Day” (April 2). I’m including a close-up of his big-boy sign below showing just China as an example:

Note that Trump’s tariff on China since this chart was published has increased to 125% plus a 20% ‘fentanyl tariff’, totalling 145%.

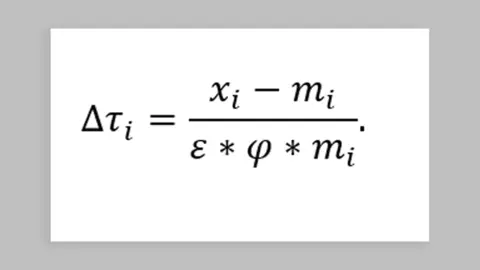

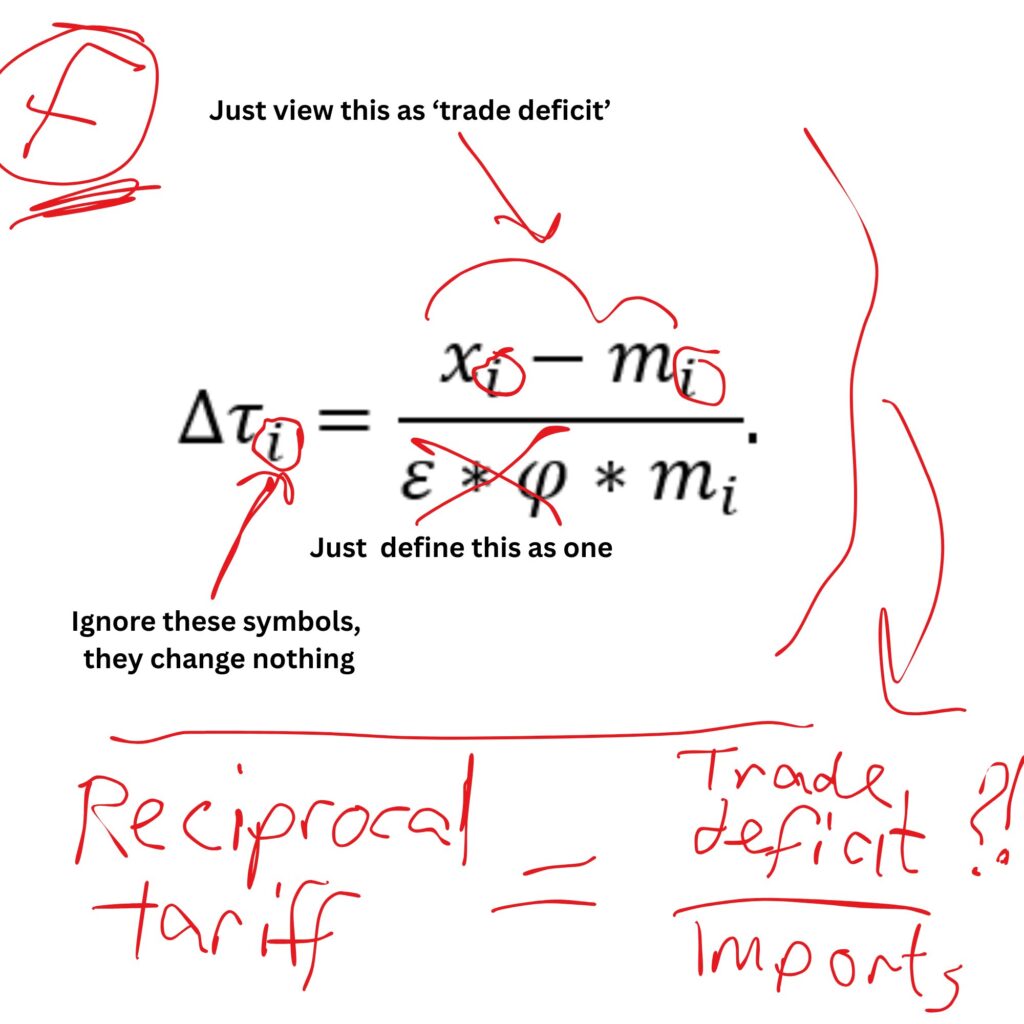

Experts could not make any sense of the ‘Tariffs charged to the U.S.A‘ column. None of these numbers matched any known foreign tariffs: where had Trump’s team come up with these values? Well that’s an interesting question.

Apparently an actual formula was used, contrary to the logical assumption that these numbers were dug up by Trump’s proctologist. The formula was complete bullshit, but it looked rather fancy:

But the real formula once parsed to include the actual values used by Trump’s team of idiots looks like this:

So basically Trump’s tariff plan is penalizing countries for having a trade deficit with the U.S.. Trade deficits are not a tariff. A trade deficit basically means the U.S. buys more from the foreign country than the foreign country buys from the U.S..

I have a trade deficit with the local gas station: I buy gasoline from them, but they never buy anything from me. The U.S. has a trade deficit with Canada: they have nearly 10 times our population and buy a ton of natural resources from us. We simply cannot buy enough from them to keep up with their population’s consumption.

A trade deficit also isn’t some kind of ‘cheating’ or ‘rip-off’ being perpetrated by the foreign country. The U.S. isn’t ‘gifting’ other countries with anything: the other countries provide goods which the U.S. pays for with money.

The U.S. has the largest economy on the planet: they buy more from pretty much everyone than is purchased in return. They need vast amounts of goods and resources, many times what they can produce themselves, to keep their economy healthy. American firms make huge profits off of goods that come in to the U.S. to be resold to U.S. consumers. The U.S. economy would collapse if it stopped importing at the levels it currently does.

Applying blanket tariffs to a country because of a trade deficit is incredibly stupid. Trump may have sensed how bad things were going on April 9th when he implemented a 90 day pause on his ‘Liberation day’ tariffs. I still don’t think he realizes yet how stupid his strategy is.

Unpacking the ‘why’ of it

So why are Trump and his merry band of idiots implementing tariffs? Part of it is that Trump and at least some of his advisors believe their own lies. But what are the excuses for the tariff pauses and restarts we’ve seen? Here are the possible rationales I’ve identified:

- Trump truly believes tariffs will bring manufacturing back to America

- He wants to bring back the Gilded Age from e.g.: the way the economy worked from 1860 to 1930

- Possibly: This really only works if you accept the ‘enshittification’ of America: see below. And it is still incredibly ignorant

- tariffs are a negotiation tactic to get deals with other countries

- “Trump is a genius business man; it is the ‘Art of the Deal’; he is playing 5D chess”

- False: even a half-wit knows that you don’t destroy your own economy as the first step of your ‘negotiation’. He could have set a deadline 90 days in the future with his big-boy chart showing the planned tariffs and invited everyone to come negotiate. Instead he started the tariffs day one and insisted there was no room for negotiation

- This probably would have still unsettled the stock market and blanket tariffs are still incredibly stupid, but at least it could have resulted in some kind of benefit

- Some people have benefitted from the tariff stops, starts, and rumours. People with inside information about what stupid thing Trump is about to say next have made timed investments on which direction the market will go in the next few hours. But the market as a whole has lost trillions, and insider trading is illegal for a reason

- Trump is a egotistic toddler with no real clue what he’s doing

- True: this rationale clearly fits the facts in evidence. Trump has spent most of his life living entirely without consequence, prospering from his early inheritance and his ‘gift’ of being able to manipulate other people with lies and threats. Now he has carefully surrounded himself with people who profess undying loyalty to him in order to get their hands on the levers of power. People like Peter Navarro and Howard Lutnick. Trump may not want to destroy the U.S., but he definitely wants to leave a huge ‘mark’ on it emblazoned with his name: and that, coupled with the people who surround him, makes him dangerous.

Gilded age 2.0

I think the current situation with Trump’s tariffs is a combination of rationale #1 (tariffs bring back manufacturing) and rational #3 (Trump is a toddler). I began to see a number of connecting threads that strengthened this belief as I thought more about the actions of the new U.S. administration.

Why and how did manufacturing (and services) leave the U.S.?

U.S. laws were changed in the 1980s (during the Reagan era) that removed or weakened obstacles to corporations moving work overseas. These changes were ones lobbied for by very wealthy Americans and large U.S. firms as a way to raise profit and stock prices by reducing costs. The labour pools in countries like China and India were huge and cheap: far less expensive than work performed by Americans.

Clearly moving work out of the U.S. would negatively impact American workers. But as long as the rich got richer it would all ‘trickle down’: that was the bullshit sold to the U.S. voters. What really happened over the course of about 30 years is that manufacturing and then services moved to extremely poor nations with incredibly lax regulations. These are places Trump (in his toxic way) would call “shithole countries.”

The obstacles to American companies moving jobs overseas were removed via a largely bi-partisan process. Republicans and Democrats high-fived each other as large corporations poured billions into lobbying for ever-looser offshoring rules.

Factories sprang up in places like India and China, then gigantic office complexes, and eventually entirely new industries. Millions of jobs were displaced from the U.S. to places with minimal worker protections, little or no social safety net (e.g.: no pensions), and few regulations about pollution, vacations, or anything of that nature.

Initially a lot of what was built overseas was low-tech but, as corporations continued to suck wealth from the process, investments overseas increased. Trillions of dollars was invested in the past few two decades of the process to build gigantic ultra-high-tech factories for chip and device manufacturing. These factories are staffed by highly trained people working 90+ hour 7 day weeks with little or no worker protection for wages a fraction of even the lowest minimum wages in the U.S..

Americans benefited by paying reduced prices for a wider variety of goods from the poorer manufacturing countries. And some new types of work came to the U.S., largely white-collar work focused in the technical services industries. But it became harder to make a living from low-skill work as these jobs shifted overseas.

Unions became weaker, in part as their worker base dwindled, and also in part as legislation protecting worker rights were weakened at the behest of corporations. Wages stagnated despite corporate profits increasing steadily. The middle class shrank as manufacturing workers lost their good-paying employment.

Then large U.S. corporations worked with their government shills to make it easier to start shifting highly skilled technical work overseas. The growth in the U.S. of good-paying white collar technical service industry work began to slow.

Who is at fault for these losses?

U.S. manufacturing jobs were lost due to regulations changed under Reagan under the ‘trickle-down’ economic theory, changes that were lobbied for by the very rich and large corporations. So the blame lies with:

- the very rich in the U.S.

- corporations in the U.S.

- U.S. politicians

The wealth of the middle class was transferred to the wealthiest 1/10th of 1%. This isn’t the fault of foreign countries: it was the rich in the U.S. taking advantage of the working class in their own country.

Enshittification of the U.S.A- A stupid way to move the work back

Offshoring U.S. manufacturing and large swaths of their white collar technical work has taken nearly 50 years. There is no practical way to reverse this process without massive upheavals over a period of decades. Factories take years to build and cost billions of dollars: no company is going to make such an investment just staff it with people who cost several times as much to employ. The global economy has become incredibly inter-connected, and there are too many benefits to this new way of doing things.

There are some smart things that could be done to preserve and enhance work opportunities in the U.S. over the course of a decade or so. Taxing very rich individuals and large corporations at rates similar to those applied in the post WWII era could fund massive infrastructure projects similar to those in China. Think in terms of huge investments in renewable resources, high speed mass transit, space industry, and next-generation battery technologies. There is also an overwhelming need to refresh more basic American infrastructure: replacing crumbling roads, bridges, dams, and so on could employ hundreds of thousands for decades. Along with these investments, laws could be changed to strengthen unions and reduce the influence of money on politics i.e.: reversal of the Citizens United ruling.

Unfortunately, we live in the stupidest timeline, and that my friends is what I think Trump and his loyalists are aiming for- the stupidest possible way to bring jobs back to the U.S..

Here is the stupid plan:

- Step 1: make foreign goods incredibly expensive

- Tariffs, baby! Massive, beautiful tariffs, so no American can buy anything from outside the U.S. of A.

- Step 2: make American workers incredibly poor so not only can’t they afford foreign goods, they can’t even afford food and shelter

- No increases to minimum wages, increasing cost of basic goods (inflation- tariffs help this go up too!)

- Step 3: remove any and all healthcare, pension, VA, or child care/education benefits

- DOGE, baby!

- Step 4: remove worker protections, minimum wage rules, child labour laws, and unionization rules

- DOGE again, baby! Plus put the most incompetent people you can possibly find in charge of every department, preferably an incompetent billionaire

- Step 5: remove any laws that slow industrialization e.g.: pollution laws

- DOGE just keeps on giving- the laws are meaningless if the departments that review and apply those laws are gone

- Step 6: remove any laws that control use of natural resources e.g.: drilling regulations, forestry conservation, national parks

- Drill baby, Drill! Trump has also signed executive orders authorizing clear cut logging and mining in national parks

At the end of all that, you have turned the U.S. into what the other nations like China and India were forty or fifty years ago. I won’t mention all of the planned racism, sexism, and religious bigotry in Project 2025: just the economic stuff is bad enough. The U.S. would be what Trump would call a ‘shithole country’, but he and his closest associates would be rich so who cares?

People would be desperate for any source of income: children and the elderly would work 16 hour days for enough money to buy food to eat. This would encourage large corporations to build factories to consume the incredibly cheap and pliable labour pool. The absence of pollution, environmental, and resource management regulations would accelerate the construction and operation of these factories.

The cheap workers could be forced to labour 90 plus hours a week for $2.00 or less per hour because the alternative would be starvation. Parents would happily send their children to work as well: to avoid sacrificing their education they could work the 9:00PM to 7:00 AM shifts.

America would start to rise up from shithole status to something slightly better in two or three decades: everyone would still be poor, but they’d forget that there was once an alternative. Wealth concentration in a vanishingly small few would increase to even higher levels than before. ‘Happy’ workers labouring 14 hours a day for seven days a week would make America productive again. Suicide nets on factories and their attached live-in worker dormitories would catch the few weaklings not able to handle the constant winning.

Anyone protesting would be a criminal, and criminals incarcerated in the for-profit prison system would be working for free- even more winning! All that wealth Trump promised would definitely be there: just look at how rich the 20 or 30 people standing next to him are!

What I really think will happen

The Gilded Age 2.0 dystopia may be what Trump and his Project 2025 associates imagine as their desired outcome, but I don’t think it will go down that way. However, their attempts to move in that direction will continue to destabilize the U.S. economy.

Trump tariffs of 10% to 20% will continue to be broadly and stupidly applied. Some countries will negotiate exclusions for the more extreme tariffs, but when the 90 day pause expires in June I expect at least some of the higher tariffs will kick back in. The stock market will recover some ground but will start to establish a downward trend with great instability particularly when the tariff pause ends. By June or July a clear recession will be in progress.

“Great instability” in the market will largely be attributed to the amazingly inconsistent / stupid messaging from Trump and his administration. For example, consider the recent announced carve-out for Apple’s imports from China. Trump almost immediately said “Apple gets no exemption!”, contradicting what his own people said and causing a great deal of confusion. Apparently, the carve-out ‘only’ saves Apple from the post-Liberation Day 125% tariff against China, but not the ‘older’ (early in March) ‘fentanyl tariff’ against them of 20%. In Trump’s mind, this means they Apple isn’t getting an exemption…

Inflation will start to increase in June as the effect of the tariffs reaches consumers. The instability of the stock market will generally reduce confidence in the U.S. economy, and U.S. treasury bond rates (and thus interest rates) will increase.

The treasury bond situation: it could get much worse

There are couple of more extreme disrupters that I think are in play in addition to Trump’s own vast ignorance and ego. Trump’s continued 145% tariff on China may trigger a more dangerous response from the second biggest economy in the world: they may start to sell off their U.S. treasury bond holdings.

Japan and China hold nearly two trillion U.S. dollars worth of U.S. treasury bonds between them. They do this because keeping your largest trading partner financially solvent is good business. Treasury bonds are basically ‘loans’ to the U.S. government to fund its debt. The bonds pay a particular interest rate: U.S. bonds normally pay a fairly low rate as the U.S. government is considered to be both stable and a good partner.

The U.S. is forced to increase the rates paid on bonds if the bonds start to sell off. They need to do this to incentivize someone else to quickly buy the bonds up or else they will become insolvent. This is what started happening on April 8th: Japan started selling off some of their U.S. treasury bonds and the bond rate started to climb just before Trump ‘blinked’ and put a delay on the tariffs.

If the U.S. bond rate goes up, so do consumer and corporate loan interest rates. You can imagine how disruptive that can be across the entire economy. Folks like Trump and Musk who are highly leveraged i.e.: have a bunch of gigantic loans can very rapidly become insolvent if loan rates go up.

Trump and his advisors seem to be forgetting that China holds a gigantic ‘stick’ they can use because of their bond holdings. If Trump keeps screwing around, insulting China and applying abusive tariffs, he may very abruptly find out just how weak his hand actually is.

References

- Comments from Commerce Secretary Howard Lutnick=> https://www.thedailybeast.com/trump-lackeys-cant-get-their-story-straight-on-the-point-of-his-tariffs/

- the other big tariff player in Trump’s cabinet is “Senior trade counsellor” Peter Navarro

- Trump is starting to ‘blink’ with pressure from Musk=> https://www.thedailybeast.com/elon-musk-goes-nuclear-on-trump-tariff-guru-peter-navarro-with-jaw-dropping-slur/

- A billionaire republican donor calls the trade war a huge mistake=> https://www.thedailybeast.com/billionaire-gop-megadonor-rips-trumps-huge-trade-war-mistake/

- Right wing influencers say tariffs will bring ‘masculine’ jobs back to America=> https://www.thedailybeast.com/maga-rolls-out-bonkers-new-justification-for-trumps-trade-war/

- Trump says Americans want to work in coal mines, not build ‘widgets’=> https://gizmodo.com/trump-says-americans-yearn-for-the-coal-mines-2000586773

- Trump blinks: 90 day pause of (most) tariffs=> https://www.wsj.com/livecoverage/stock-market-trump-tariffs-trade-war-04-09-25

- Signs of recession=> https://www.bbc.com/news/videos/c70ze6reykno

- Dropping GDP

- Dropping Consumer Sentiment index

- Dropping employment

- Trump Tariffs stupid formula is so wrong=> https://www.cnn.com/2025/04/08/business/video/trump-tariffs-math-equation-wrong-economist-veuger-cnc-digvid

The US is 1/30 of the world population and 1/4 of its market. That makes it a desirable market, especially if you sell things like ridiculously over priced athletic shoes.

But it isn’t an essential market. A nice lucrative market, but not truly essential on a global scale.

If the US locks itself off from the rest of the world, eventually, with much pain, the rest of the world will reconfigure its trade to work around the United States.

There are numerous historical examples of countries that walled themselves off behind trade barriers. It has never ended well for the countries in question.

One wonders who will be America’s Commodore Perry.

A good point, Chris- the U.S. may dominate the global economy, but it isn’t the entirety of the economy.

There is and will continue to be a lot of pain caused globally, however, by whatever dumbass things Trump comes up with next. I think, however, that the greatest economic harm he does will be to his own people. Other kinds of harm like that which comes from his choices around things like the Ukraine war are far more tragic.

I am not smart enough to figure it all out, heck I have a hard enough time balancing my day to day!

But what Trump doesn’t know, is incredible, maybe not really, he has bankrupted how many businesses, and been bailed out. I know us Canadians have our own issues with our leaders but Trump. A President, again. Oh and just wait, until he removes term limits..it will happen.

“What Trump doesn’t know is incredible”: well said, Shane 🙂

As for term limits- he has ‘ideas’ about getting more terms, so yeah, I don’t expect him to leave in 2029 without a fight. I’d like to see some kind of overwhelming change in the midterms, but history suggests that the Americans will probably still vote like a bunch of Nazis on crack.